Where Are Mortgage Interest Rates Headed in 2018?

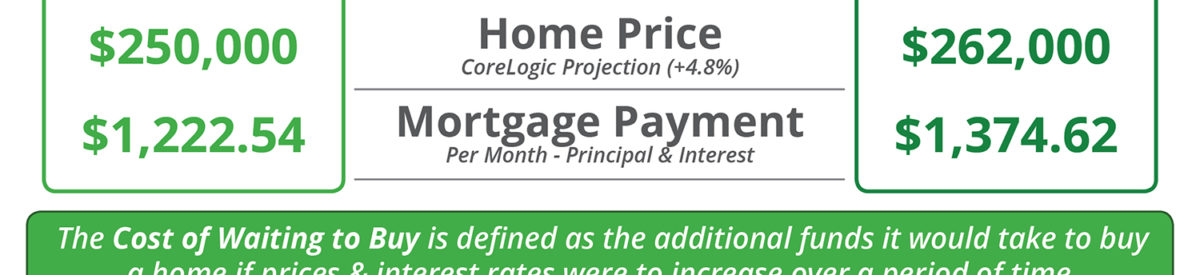

The interest rate you pay on your home mortgage has a direct impact on your monthly payment. The higher the rate the greater the payment will be. That is why it is important to know where rates are headed when deciding to start your home search. Below is a chart created using Freddie Mac’s U.S. Economic